What trends should you look for to identify stocks that have the potential to double in value over the long term? Typically, you look for an increasing trend in return on invested capital (ROCE) and the associated trend of growing invested capital. Essentially, this means that a company has profitable endeavors that it can continually reinvest in, which is the nature of a compounding machine. Speaking of which, we’ve seen a big change in return on invested capital for Indian Railway Catering & Tourism (NSE:IRCTC), so let’s take a look.

What is Return on Invested Capital (ROCE)?

For those unfamiliar, ROCE is a metric that assesses how much pre-tax profit (as a percentage) a company earns on the capital invested in its business. The formula to calculate this metric for Indian Railway Catering & Tourism is:

Return on Invested Capital = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.41 = ₹140B ÷ (₹610B – ₹260B) (Based on the trailing twelve months to March 2024).

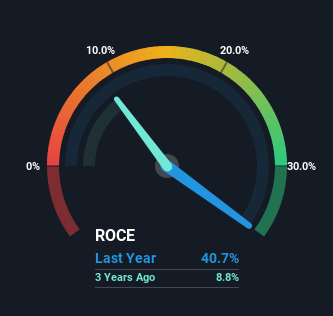

Thus, Indian Railway Catering & Tourism has an ROCE of 41%, which is not only an excellent profitability ratio, but also above the 16% average for companies in a similar industry.

View latest analysis for Indian Railways Catering & Tourism

In the chart above we’ve measured Indian Railway Catering & Tourism’s prior ROCE against its past performance, although the future is arguably more important. If you’re interested you can see analyst forecasts in our free analyst report on Indian Railway Catering & Tourism.

So how is Indian Railway Catering & Tourism’s ROCE trending?

We like what’s happening with Indian Railway Catering & Tourism. Over the past five years, return on invested capital has increased substantially to 41%. It’s worth noting that the company has substantially increased its return on each dollar of invested capital and the amount of capital has also increased by 204%. Increasing return on increasing capital amounts is a common trend among multi-baggers, which is why we’re impressed.

Another thing to note is that Indian Railway Catering & Tourism has reduced its current liabilities to 43% of total assets over this period, effectively reducing the amount of funding it has from suppliers and short-term creditors. Shareholders will therefore be pleased to see that the increase in earnings is mainly due to underlying business performance. However, keep in mind that current liabilities are still at fairly high levels, which could pose some risks.

The conclusion is…

In summary, it’s great to see Indian Railway Catering & Tourism being able to compound its earnings by continually reinvesting capital and increasing its return, as these are some of the key ingredients of a highly sought-after multi-bagger. And the astounding 144% total return over the past three years suggests investors are expecting even better things to come in the future. That being said, we believe this company has promising fundamentals that make it worth doing some further due diligence.

Indian Railway Catering & Tourism presents some risks, and we’ve spotted 2 warning signs (and 1 which is a bit unpleasant) we think you should be aware of.

If you want to search for more stocks with high profit margins, check out this free list of stocks that have strong balance sheets and high return on equity.

Valuation is complicated, but we can help make it simple.

Check our comprehensive analysis, including fair value estimates, risks and warnings, dividends, insider transactions, financial position and more, to see if Indian Railway Catering & Tourism is overvalued or undervalued.

View your free analysis

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.

Valuation is complicated, but we can help make it simple.

Check our comprehensive analysis, including fair value estimates, risks and warnings, dividends, insider transactions, financial position and more, to see if Indian Railway Catering & Tourism is overvalued or undervalued.

View your free analysis

Have something to say about this article? If you have any questions about the content, please contact us directly or email us at editorial-team@simplywallst.com.