Sidney de Almeida/iStock Editorial via Getty Images

“The safest, most efficient, sustainable and comfortable airport in the world; a catalyst for the economy and tourism, and a creator of value for shareholders, customers and society” – Aena’s mission

If you’ve ever been stuck in a long airport queue and thought how great it would be to make money from every passenger, you might want to consider Aena ( OTCPK:ANYYY ). The company essentially owns all of Spain’s major airports, has significant concessions in Brazil, and holds about 6% of Grupo Aeroportuario del Pacifico (PAC).

Aena is particularly attractive for a few reasons. First, Spain is quickly becoming one of the world’s most attractive tourist destinations. Second, around 80% of international tourists arrive by plane; this percentage is likely to be even higher given the high concentration of fast-growing low-cost airlines that fly to and from Spain, such as Ryanair (RYAAY) and Vueling (OTCPK:ICAGY). Finally, the company is very generous with its dividend, with a policy of returning around 80% of its profits through dividends.

Company Profile

Like most airports, AENA generates some of its revenue from a combination of regulated and unregulated business. Its regulated business is primarily the fee it charges per passenger using its airports, which is roughly X per passenger and has remained constant at X for several years, but which has increased by Y% compared to last year.

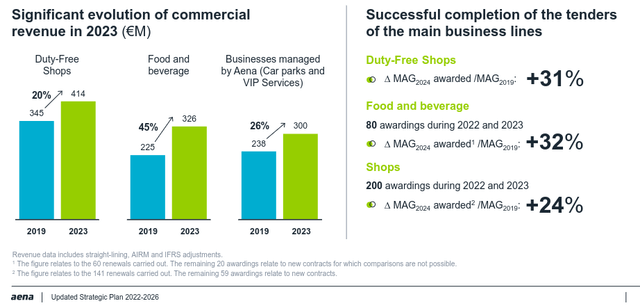

The remaining revenue is generated through a variety of businesses, including duty-free shops and other airport retail, restaurants, hotels, and renting out space to car rental companies such as Avis (CAR) and Hertz (HTZ). The unregulated sector has seen particularly strong growth in the past few years.

One important thing to mention is that the Spanish government holds a controlling interest in the company through a 51% stake. This can be an advantage, but also a potential disadvantage: the government is motivated to see the company prosper, and in some cases its priorities and interests may not be entirely aligned with those of minority shareholders.

Spain

Spain has a lot to offer international visitors, whether you want to try one of San Sebastian’s many Michelin-starred restaurants, admire the architecture of Barcelona, visit Madrid’s many world-class museums or party in Ibiza.

While it’s not particularly cheap, it’s certainly affordable compared to traditional destinations like Paris and Rome. Europe in general, and Spain in particular, attracts more tourists than business travelers. This is a big advantage right now, as tourism is seeing a more dramatic recovery compared to business travel. Spain is currently experiencing a very strong tourism boom, which has resulted in the Bank of Spain raising its GDP growth forecast for the country.

Karen Arnold

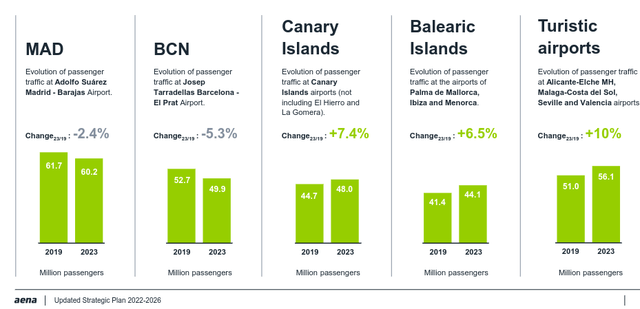

In fact, Aena’s airports that are most exposed to tourists are the ones that perform best. One thing we like about Aena is that, unlike other airport groups, it is very diversified. For example, we like Grupo Aeroportuario del Sureste (ASR), but there is no doubt that its performance is heavily influenced by Cancun airport. Similarly, we like Grupo Aeroportuario del Pacifico, but it is heavily dependent on Guadalajara airport. We also see high geopolitical risk in Mexico, and ASR has the added risk of another hurricane devastating Cancun, as Hurricane Wilma did in 2005, destroying an estimated 110 hotels in Cancun alone.

Aena Investor Presentation

Finance

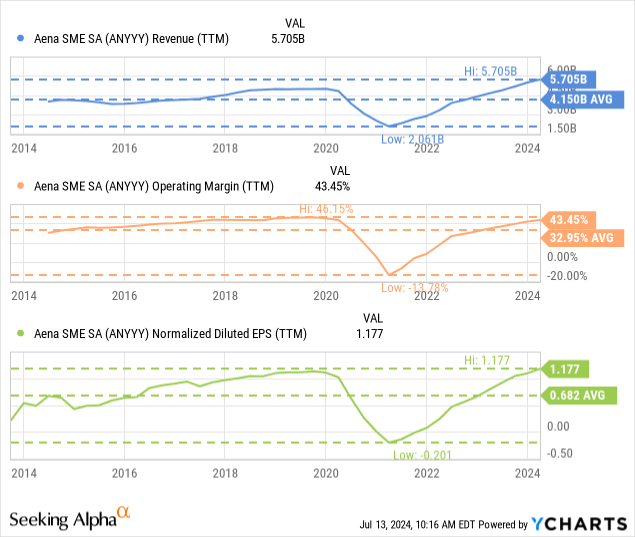

It took a few years, but Aena is now generating higher revenue compared to pre-pandemic years. Similarly, operating margins have mostly recovered but remain slightly below all-time highs, in part due to higher operational costs resulting from higher electricity prices and rising wages. Nevertheless, as the company continues to grow revenue, we believe that operating leverage and efficiency initiatives will enable it to further improve margins. Earnings per share (EPS) are at an all-time high and we see potential for growth in the coming years.

Data by YCharts

Data by YCharts

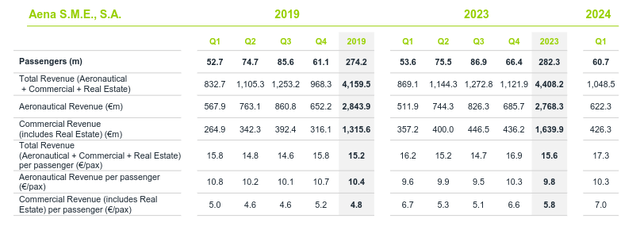

One reason for our optimism is that the regulator approved an increase in the fare per passenger, which is now €10.3 per passenger compared to €9.8 in 2023. Revenues from unregulated activities will grow even more significantly, with the company earning an average of €7 per passenger compared to €5.8.

Aena Investor Presentation

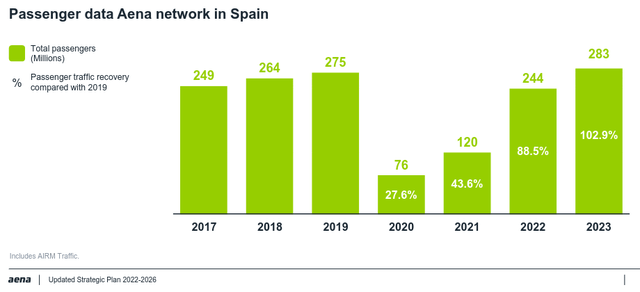

growth

Aena is also preparing for a strong investment period to grow its regulated asset base between 2027 and 2031. The company is also rapidly expanding its international business, which it hopes will account for around 15% of EBITDA by 2026. Aena has also accelerated its target of serving 300 million passengers at Spanish airports, which it now expects to reach in 2025.

Aena Investor Presentation

The airline is also rapidly expanding its international operations, having recently acquired operating rights to 11 airports in Brazil. Nevertheless, commercial revenues have grown significantly since 2019 and are becoming increasingly important to the company, and should not be underestimated.

Aena Investor Presentation

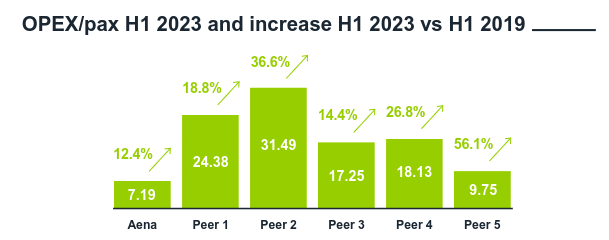

Leadership in Efficiency

While airports naturally have competitive advantages, we were impressed by the company’s competitive advantage as a low-cost airline: its operating costs per passenger are significantly lower than its peers. This allows the company to attract low-cost airlines while still making significant profits.

Aena Investor Presentation

sustainability

According to CDP, Aena is one of the most sustainable airport operators in the world. This has benefited the business in many ways. For example, solar installations have helped to mitigate rising electricity bills due to rising natural gas prices after Russia’s invasion of Ukraine. The company has also been able to issue green bonds, which typically provide more competitive financing if the company achieves certain sustainability targets. It has also allowed the company to be part of indexes such as the Dow Jones Sustainability World Index and FTSE4Good.

Company Factors CDP Grade AENA SME SA Climate Change 2023 A- ADP, Aéroports de Paris Climate Change 2023 B Airports of Thailand Climate Change 2023 F Grupo Aeroportuario del Pacifico Climate Change 2023 B- Grupo Aeroportuario del Sureste Climate Change 2023 C Click to enlarge

Balance sheet

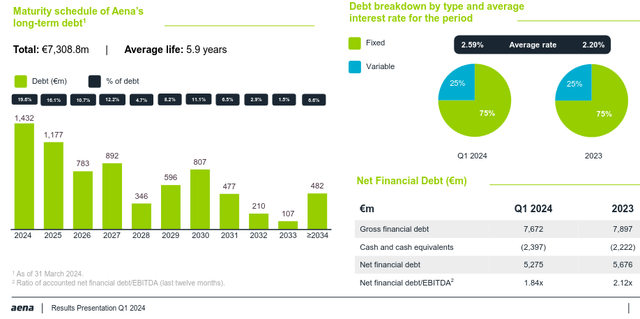

Aena’s balance sheet is very strong, with net financial debt to EBITDA at just 1.8x at the end of the first quarter, but it is important to note that average interest costs are increasing. This could be a headwind for some time, as the company is refinancing maturing debt issued when interest rates were very low into higher current interest rates. Still, very few companies have average interest rates below 2.59%.

Aena Investor Presentation

evaluation

Aena currently offers an attractive dividend yield, largely due to the company’s policy of a dividend payout ratio of approximately 80%. The dividend yield is currently around 3.9% in euro terms, but will likely increase as earnings grow. The company only needs modest revenue and earnings growth to justify its forward-looking GAAP P/E ratio of 14.6x.

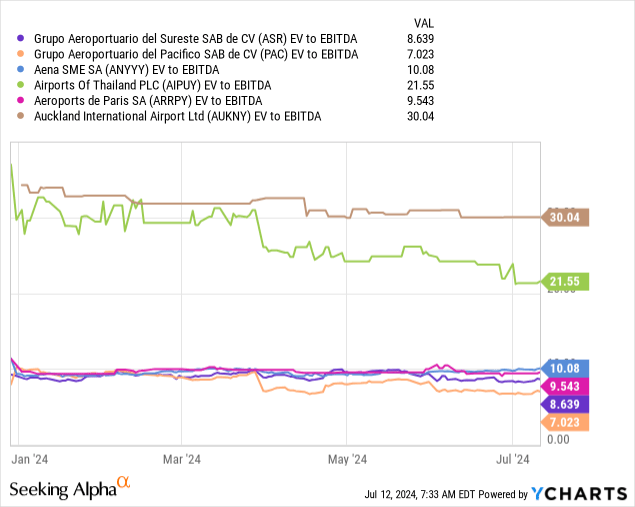

On an EV/EBITDA basis, Aena’s shares are certainly attractive when compared to Airports of Thailand (OTCPK:AIPUY) and Auckland International Airport (OTCPK:AUKNY). Aéroports de Paris (OTCPK:ARRPY) is slightly cheaper, but we believe Aena has better growth prospects and that the company deserves a premium price over Mexico’s major airport groups, given the latter’s higher risk profile.

Data by YCharts

Data by YCharts

risk

As mentioned above, we believe Aena has a lower risk profile than many other companies. That said, there are some important points to consider. The fact that the government remains the largest shareholder is a double-edged sword: its interests may not be fully aligned with those of minority shareholders. There is also a risk that the share price could fall if the government were to sell some of its holdings.

There is also a risk that Spain’s tourism boom will slow down or even reverse. Already, some cities have seen backlash against overtourism and complaints that short-term rentals such as Airbnb (ABNB) and Booking (BKNG) are taking away housing supply from locals. Indeed, Barcelona has already announced plans to ban platforms such as Airbnb from November 2028. There were also protests where thousands marched to demand further restrictions on tourism, some of whom sprayed tourists with water pistols. This is not unique to Barcelona, as similar protests by local residents have been seen in other tourist destinations such as Mallorca.

Conclusion

Considering that roughly four out of five international visitors to Spain travel by air and AENA controls all the major airports, the company is essentially the “toll booth” for tourists visiting Spain. This makes AENA an interesting investment opportunity to profit from Spain’s growing popularity as a travel destination.

The company is well diversified, with only about a fifth of passenger traffic at Madrid airport. The company is expanding internationally with a significant concession in Brazil and commercial business is progressing well. We believe the company’s shares are fairly valued, with an attractive dividend yield and good prospects for earnings per share growth. The main risk we see is a backlash from local residents in some of the most popular tourist destinations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.