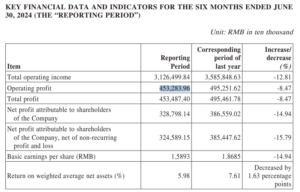

China: China Tourism Group Duty Free Corporation (CTGDF), the parent company of China Duty Free Group (CDFG), the world’s largest travel retailer by sales, announced that its sales for the first half of the year ended June 30 fell 12.81% from the same period last year to RMB31.265 billion (US$4.3 billion).

Net profit decreased 14.94% year-on-year to RMB3.288 billion (US$453.5 million).

The year-on-year results for the first half of the year were heavily influenced by comparisons with January to April 2023, the period before the crackdown on proxy purchasing (see Goldman Sachs note below).

The gross profit margin of our core business (CDFG) in the second quarter was 33.29%, up 0.82 percentage points year-on-year and 0.59 percentage points quarter-on-quarter, demonstrating the continued improvement of our key indicator, CTGDF.

Commenting on its performance, the group highlighted a “complex and challenging external market environment.”

The company said that in the face of these challenging circumstances, it has focused on steady growth, promoting reform and striving for development.

The first-half results highlight the tough market environment in its key market, Hainan province. {Source: China Tourism Group Duty Free Shop; click to enlarge}

The first-half results highlight the tough market environment in its key market, Hainan province. {Source: China Tourism Group Duty Free Shop; click to enlarge}

The CTGDF highlighted four specific measures it is adopting to drive business improvements.

First, it plans to revive its traditional businesses and improve profitability. During the reporting period, sales at CDFG’s China-based international departure and arrival duty free stores increased by more than 100% year-on-year, driven by the continued recovery of international flight and passenger numbers. Profitability also continued to improve.

Sales at duty-free shops at Beijing airports (Beijing Capital International Airport and Daxing International Airport) increased by more than 200% year-on-year.

According to the CTGDF, sales at duty-free shops at Shanghai’s Pudong International Airport and Hongqiao International Airport nearly doubled, and net profits also increased significantly.

A spectacular interior view of the new Block C shopping zone at cdf sanya international duty free shopping complex. The situation remains tough in Hainan province, which has been hit hard by the 2023 restrictions on reseller trade compared to last year.

A spectacular interior view of the new Block C shopping zone at cdf sanya international duty free shopping complex. The situation remains tough in Hainan province, which has been hit hard by the 2023 restrictions on reseller trade compared to last year.

Secondly, CTGDF committed to enhancing service quality and efficiency and strengthening Hainan’s significant offshore duty-free market. CTGDF’s dominant position in that channel and related market share have steadily increased.

Goldman Sachs Research said in a note just before the earnings release that it expects Hainan’s duty-free sales trends to improve year-over-year in the coming months as the impact of the crackdown on proxy purchasing fades from May to June onwards.

CDFG has sought to establish benchmarks in terms of service, management and value creation to foster comprehensive and systematic improvement in operational and service standards.

Third, CTGDF said it will continue to promote overseas expansion and expand domestic sales channels. The company has implemented the national “Belt and Road” strategy, and promoted the opening of duty-free operations for Adora Magic City Cruise Line and the Qeelin boutique at Singapore Changi Airport.

CDFG also won public tenders to operate the MCM boutique at Singapore Changi Airport and the Qeelin boutique at Hong Kong International Airport.

In China, it has acquired the rights to operate departure duty-free shops at Terminal 1 of Guangzhou Baiyun International Airport and Kunming Changshui International Airport.

The fourth priority is to continue strengthening the Group’s ESG program, including in collaboration with business partners.

According to the CTGDF, during the reporting period, the company was included in several major ESG indexes and achieved breakthrough improvements in several domestic and international ESG ratings.