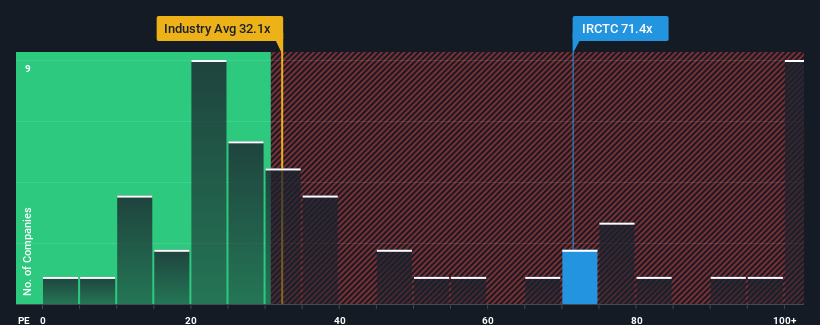

Indian Railway Catering & Tourism Corporation Limited (NSE:IRCTC) has a price-to-earnings (P/E) ratio of 71.4x, which may be sending out a very bearish signal at present, given that almost half of Indian companies have P/E ratios below 34x, and P/Es below 19x are not uncommon. That said, we need to dig a little deeper to determine whether there is a rational basis for the sky-high P/E.

Indian Railway Catering & Tourism has been relatively underperforming with poor earnings growth compared to most other companies in recent times. Many are expecting a strong recovery in the company’s lackluster earnings performance, which may be limiting the decline in its P/E multiple. Existing shareholders may otherwise be very nervous about the viability of the stock.

View latest analysis for Indian Railways Catering & Tourism

Is there enough growth in catering and tourism in Indian Railways?

There is essentially an assumption that for a P/E ratio for a company like Indian Railway Catering & Tourism to be considered reasonable, the company must be performing significantly better than the market.

Looking back first, we can see that the company delivered a healthy 10% growth rate in earnings per share over the last year. This is backed up by an impressive period in which EPS has increased a combined 494% over the past three years. Therefore, let’s start by establishing that the company has done a great job of growing earnings over that period.

Speaking of the outlook, the seven analysts monitoring the company are predicting a growth of 20% annually for the next three years. With the market expected to grow at 21% annually, the company is well positioned to achieve comparable revenue results.

From this information, we find it interesting that Indian Railway Catering & Tourism is trading at a high P/E relative to the market. It seems that most investors are willing to ignore fairly average growth expectations and pay a high price for exposure to the stock. These shareholders may stand to be disappointed if the P/E falls to a level in line with the growth outlook.

What can we learn from Indian Railway Catering & Tourism’s P/E?

While the price-to-earnings ratio is not a deciding factor in whether or not to buy a stock, it is a very useful barometer for gauging earnings expectations.

We find that Indian Railway Catering & Tourism’s current shares are trading at a higher than expected P/E. This is because the company’s expected growth rate is in line with the overall market. At present, we feel uneasy about the relatively high share price as expected future earnings are unlikely to support such positive sentiment for long. Unless these conditions improve, it is difficult to accept these prices as reasonable.

Having said that, we do note that Indian Railway Catering & Tourism is showing 2 warning signs in our investment analysis, and 1 of them is significant.

If these risks have you reconsidering your opinion on Indian Railway Catering & Tourism, check out our interactive list of high quality stocks to see what other stocks are out there.

New Feature: AI Stock Screener and Alerts

Our new AI stock screener scans the market daily to find opportunities.

• Companies with strong dividend yields (yields of 3% or more)

• Undervalued small cap stocks due to insider buying

• Fast-growing technology and AI companies

Or you can build your own indicator from over 50 available.

Try it free now

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell a stock, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.

Have something to say about this article? If you have any questions about the content, please contact us directly or email us at editorial-team@simplywallst.com.