The association, which represents America’s small and independent craft breweries, this week released annual U.S. craft beer production figures for 2023.

In 2023, beer production from small independent breweries totaled 23.4 million barrels, down 1% from 2022. However, the share of craft beer in the total beer market increased from 13.1% (by volume) to 13.3% in 2022. This is because the decline in craft beer sales (1%) was smaller than the decline in beer sales overall (5.1%).

Another strength for the industry is that the number of craft breweries continues to grow in 2023, reaching an all-time high of 9,683 (including 2,071 craft breweries, 3,467 brewpubs, and taproom breweries). (including 3,900 breweries and 245 regional craft breweries).

The total number of operating breweries in the U.S. is 9,812, up from 9,730 in 2022. During the year, 495 new breweries opened and 418 closed.

The number of store openings has been decreasing for two consecutive years, a trend that reflects the maturation of the market. Although the closing rate increased in 2023, it remained relatively low at around 4%.

The trajectory of craft beer

Craft beer experienced strong growth in the 1990s and 2000s (at times achieving double-digit growth rates), but by 2019 it had already become a more mature market with healthy and stable growth. (Volume growth was 4% in 2019, driven by industry growth and a decline of 2%).

But the pandemic hit the industry hard. Craft beer producers are inherently small and medium-sized businesses and are among the most vulnerable, with many relying on taprooms and on-trade, which were forced to close at the peak of the pandemic. As a result, craft beer production in 2020 decreased by 9%.

But even though the pandemic hit hard, the industry largely recovered over the next year. But that only led him to discover new hurdles from 2021 to 2022, including rising operating and material costs, supply chain challenges, and increased competition.

Craft beer makers must also question whether inflation-hit consumers will downtrade from premium craft products to mainstream products (although U.S. data suggests the premium category is expected to (It hasn’t been hit as hard.)

Craft breweries directly employed 191,421 people in 2023, an increase of 1.1% from 2022. This has been driven by an increase in the number of breweries and a continued shift towards hospitality-oriented business models.

“2023 was another competitive and challenging year for small and independent breweries,” said Bart Watson, Vice President of Strategy and Chief Economist at the Brewers Association. said.

“Nevertheless, despite slowing growth, small breweries continue to has proven to be very resilient.”

Sales in the beer market as a whole are growing more strongly on a value basis than on a volume basis. This is primarily due to pricing, but also due to slightly stronger on-site sales growth compared to distribution volumes.

“As always, the beverage alcohol market and consumer demand continues to evolve,” Watson added. “In response, many breweries are updating their operations to align with that change, focusing on their business models, go-to-market strategies, and branding strategies.”

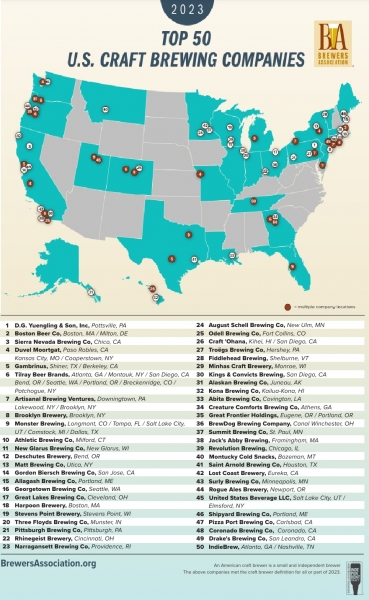

Top 50 US Breweries

The Brewers Association also released its annual list of the top 50 U.S. craft beer producers and brewers overall (based on beer sales volume).

Of the top 50 overall brewers in 2023, 40 were small, independent craft brewers.

“The distribution industry remains competitive, but we continue to see success stories and room for growth across the Top 50 list,” Watson said. “Even in times of slow growth, the strongest brands still resonate with beer lovers, regardless of company size or location.”

Top 50 breweries.Source: Sake Brewing Association

Top 50 breweries.Source: Sake Brewing Association

Source link