The United States is the top hiding place for illicit funds, according to a new report from a tax advocacy group.

This year marks the first time the United States has ranked first on the Tax Justice Network’s Financial Secrecy Index, the UK-based group said. The United States became the top four countries, ahead of traditional tax havens Singapore, Switzerland, and Luxembourg. The Cayman Islands, where many Americans think of offshore bank accounts, ranks 14th on the group’s list.

“The United States often says, ‘We’re No. 1,’ but this is one thing we don’t want to be No. 1,” said Ian Gailey, executive director of the FACT Coalition, part of the Justice Network. he said. .

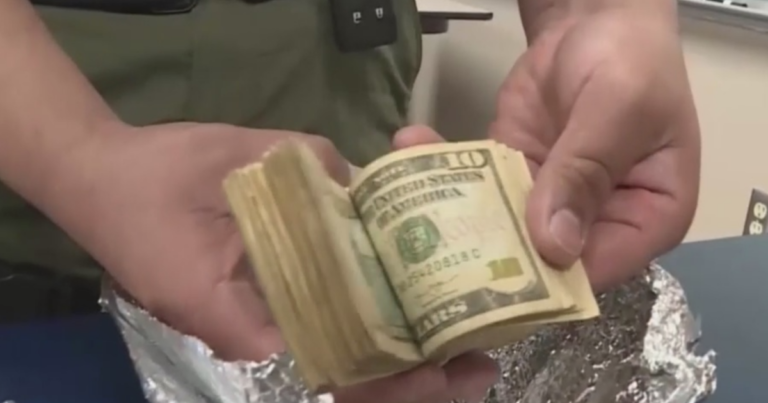

The findings come as the United States cracks down on the wealth of Russia’s oligarchs in the wake of Russia’s invasion of Ukraine. The United States has imposed financial sanctions on some oligarchs, including billionaires Alisher Usmanov and Igor Shuvalov, whose wealth lies in a complex network of real estate assets, personal investment accounts, and anonymity. The task is made even more difficult by the fact that it is hidden inside. Quartz reported that it is a shell company.

Click here to view related media.

Click to expand

The Department of Justice has created a new Kleptocapture Task Force specifically aimed at uncovering hidden Russian wealth.

The Tax Justice Network examined financial regulations in nearly 100 countries, including laws that make it easier for criminals to conceal and launder funds. Experts say the main reason the US has risen to the top of the list is the Treasury Department’s lack of funding to implement new anti-money laundering laws.

In December 2020, Congress passed the Corporate Transparency Act, which requires those forming shell companies in the United States to list the names of their owners. Under the law, the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) is responsible for enforcing the rules.

What does oligarchy mean?

But experts say FinCEN needs additional funding, personnel and technology to take on this new mission and investigate who is illegally hiding money. Biden administration officials are asking Congress to provide $210 million to FinCEN under the U.S. government’s proposed 2023 budget, an increase of about 30% from current funding.

Need stricter laws

The network concluded that nearly all developed countries should pass stricter financial laws, especially regarding ownership of shell companies. Failure to do so would allow terrorist organizations to covertly fund their operations and oligarchies to avoid taxation, the groups said.

Anti-money laundering experts say it’s unclear how much money is illegally hidden within U.S. borders. However, the US Treasury previously pegged this number at about 2% of gross domestic product (GDP), which would reach $480 billion today.

U.S. officials have long been aware of money laundering operations in the U.S., with Treasury Secretary Janet Yellen recently announcing in December that “the best places to hide and launder ill-gotten gains are actually is the United States,” he said.

Lakshmi Kumar, a terrorist financing expert at the Washington think tank Global Financial Integrity, said setting up a shell company in the United States is less hassle than getting a library card. The reason for this is that in order to use a library, applicants must have their ID verified, but this is not the case with shell companies.

More from CBS News

Christopher J. Brooks