Skift Take

Outbound travel from China is recovering thanks to preferential visa policies, expanding air capacity and growing interest in diverse destinations around the world, but challenges remain, particularly for travel to the United States.

Peden Doma Bhutia

A recovery in international travel saw more than 1.5 million Chinese nationals travel abroad during the recent Golden Week holiday, marketing technology company China Trading Desk told Skift.

The surge signals a strong recovery in global travel as pandemic-related restrictions are eased.

The easing of visa policies between China and several countries played a key role in the increase, with inbound and outbound bookings growing at a faster rate than domestic tourism during the Golden Week holiday in late April and early May, Trip.com Group told Skift.

Popular destinations and emerging trends

According to data from Trip.com Group, Chinese tourists visited more than 3,000 cities in nearly 200 countries around the world during Golden Week.

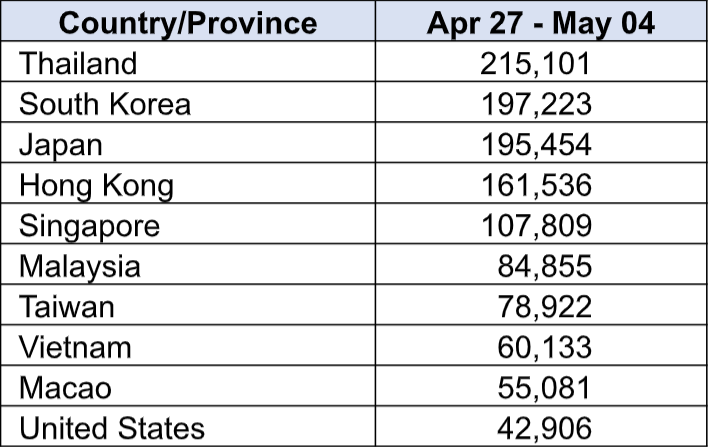

According to data from China Trading Desk, more than 215,000 Chinese tourists visited Thailand between April 27 and May 4, making it the top travel destination. Thailand’s visa-free entry policy, short flight time and cost-effectiveness compared to other destinations are among the factors driving this trend.

Subramanian Bhatt, CEO of China Trading Desk, said the numbers were strong but still not at pre-pandemic levels.

The top 10 overseas destinations most visited by Chinese travelers during this month’s Labor Day holiday. Data shared by China Trading Desk.

The top 10 overseas destinations most visited by Chinese travelers during this month’s Labor Day holiday. Data shared by China Trading Desk.

The popularity of international travel is evident from Ctrip’s report that the number of international travelers increased by 190% year-on-year. Alibaba’s Fliggy also reported that international travel bookings nearly doubled during the five-day holiday, with per capita spending on international travel significantly exceeding 2019 levels.

Alipay transactions reflect this increased spending, with overseas markets seeing a 77% increase in the first few days of Golden Week, particularly in destinations such as Thailand and Malaysia.

Challenges of US-China travel

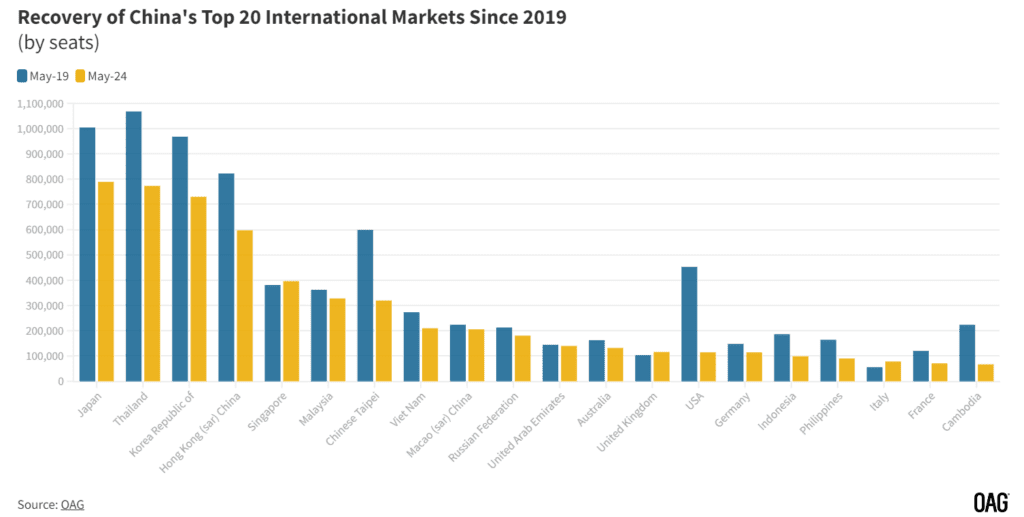

Travel to the United States remains challenging, with air capacity between the two countries remaining at about 25% of pre-COVID levels. In 2019, 70,000 travelers traveled from China to the United States over the Labor Day holiday, compared with about 42,000 in recent days.

Butt cited several reasons for this.

Limited flight availability: Delays in the resumption of direct flights and connections between China and the US are making travel planning difficult. Visa processing delays: Longer visa processing times due to staffing shortages and backlogs caused by the pandemic are a deterrent to travel. Geopolitical tensions: Ongoing political tensions between China and the US may discourage some people from traveling. Concerns about racism: There are fears about the treatment of Chinese people in the US, which may impact travel decisions.

Source: OAG

Source: OAG

Airline supply and pricing trends

A gradual, albeit limited, recovery in air service is helping: The average price per person for an international flight is down more than 10% compared to last year, according to Fliggy.

Asian destinations remain popular, with nine of the top 10 international destinations being in Asia. Bhatt attributes this to the ease of travel, increasing airline availability and visa-free travel to many Southeast Asian countries, including Hong Kong, Taiwan and Macau.

According to data from China Trading Desk, Europe continues to attract Chinese tourists, with more than 100,000 travelers heading to European countries excluding the UK over the holiday season. Trip.com reported notable increases in trips to Spain, Turkey, Austria, Slovenia, Italy and Georgia, all of which grew by more than 1.5 times year-on-year.

Domestic flights still accounted for 92% of seats available to, from and within China in May, with international flights accounting for the remaining 8%, according to aviation data firm OAG.

Changing travel preferences

There is a noticeable shift towards exploring destinations less traditionally visited by Chinese tourists. Destinations less traditionally visited by Chinese tourists, such as Austria, Turkey and Morocco, have seen the highest growth in bookings, highlighting a shift towards exploring new and diverse destinations.

Fliggy also reported a four-fold increase in bookings for long-haul trips compared to last year, including to Austria, Turkey, Morocco, Russia, Portugal, Georgia, Egypt, Spain, Kazakhstan and Brazil.

Additionally, Trip.com Group reported strong growth in travel to Middle Eastern destinations such as Oman, Saudi Arabia and Kuwait, which increased more than threefold year-on-year.

Saudi Arabia and Qatar plan to increase direct flights between China and Hong Kong as Chinese tourism resurges. Saudi Arabia, which welcomed 140,000 Chinese tourists last year, aims to attract 5 million Chinese tourists by 2030.

Photo credit: Fliggy reported a four-fold increase in bookings to Turkey, Morocco, Georgia, Egypt and Kazakhstan compared to last year.