skift take

We web-scraped over 20,000 hotels listed on Google in the US, Europe, Asia, and the Middle East to find out which online travel agencies and direct sites are vying for bookings on Google’s sponsored and organic listings. I figured out if I was competing.

Pranavi Agarwal

Skift Research’s latest report analyzes the distribution channels that bid on hotel reservations on Google Hotels, the largest and most comprehensive metasearch engine in the travel space.

We webscraped over 20,000 hotel listings across the US, Europe, Asia Pacific, Middle East and Africa. We also collected over 520,000 data points to see which online travel agents (OTAs) and direct sites are bidding on bookings and at what prices.

We collected data across both Google’s sponsored results (paid listings) and Google’s recently introduced organic auctions (which allow any site to list for free with the help of a technology partner).

Read the full report to learn about the methodology and insights gained from this unique and proprietary web scraping analysis of Google Hotels. Below are some of the key findings.

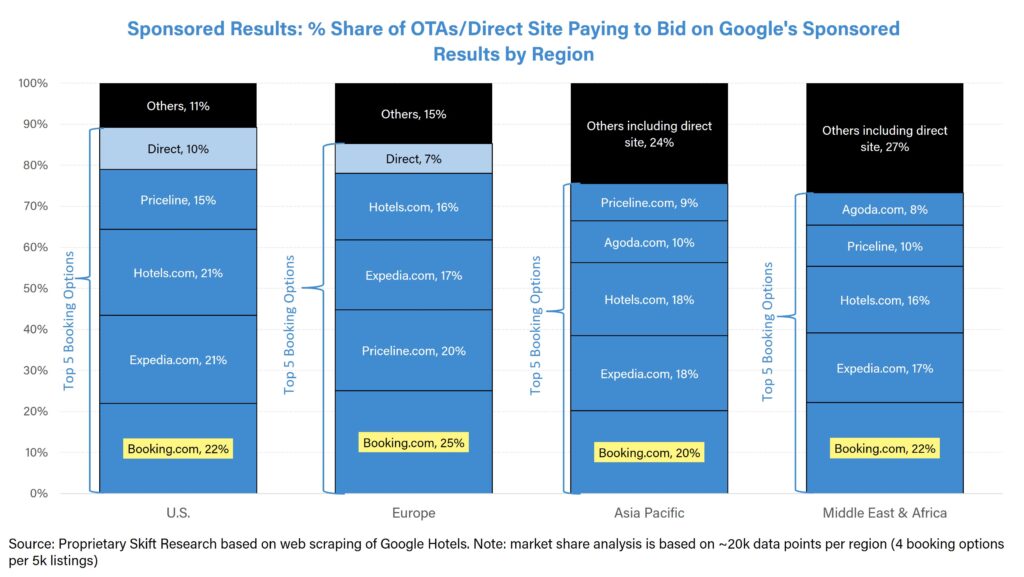

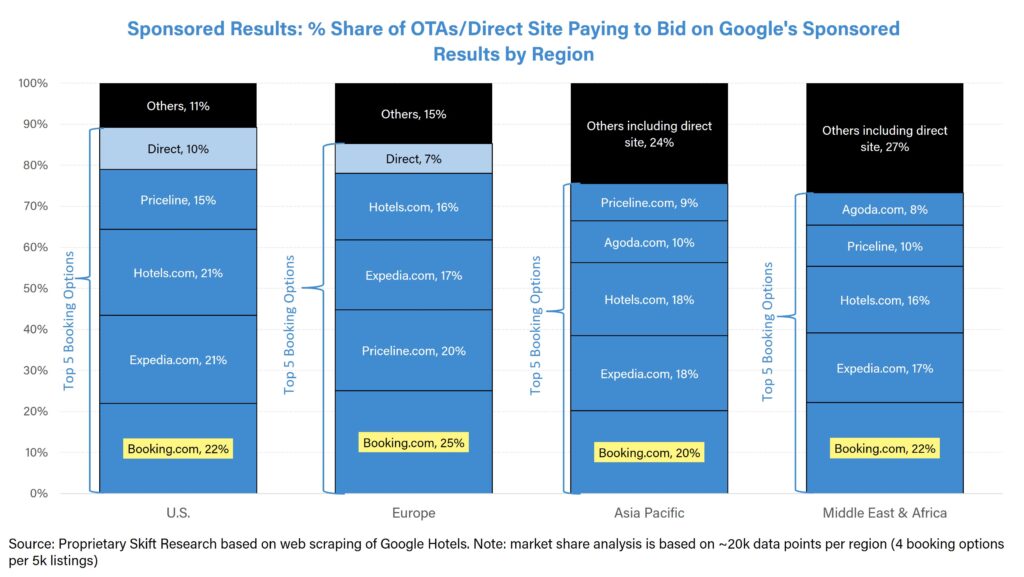

Booking Holdings and Expedia Group dominate Google’s sponsored results across all regions, with Booking.com bidding the most among OTAs.

Booking.com has a dominant presence across Google’s sponsored search results and pays to appear most often in every region. Of the top five most prominent booking options in each region, Booking and Expedia, through their sub-brands (Booking’s Priceline.com and Agoda.com, Expedia’s Hotels.com, etc.), offer better value than any other local company. I’m wearing it.

Booking.com appears most frequently in all sponsored search results in all regions, but Expedia.com invests advertising dollars to be the top choice on the list.

It is clear that Booking and Expedia will seek to compete with Booking.com, especially in regions outside of their respective home markets (Europe for Booking and the United States for Expedia), such as Asia Pacific and the Middle East and Africa. is.

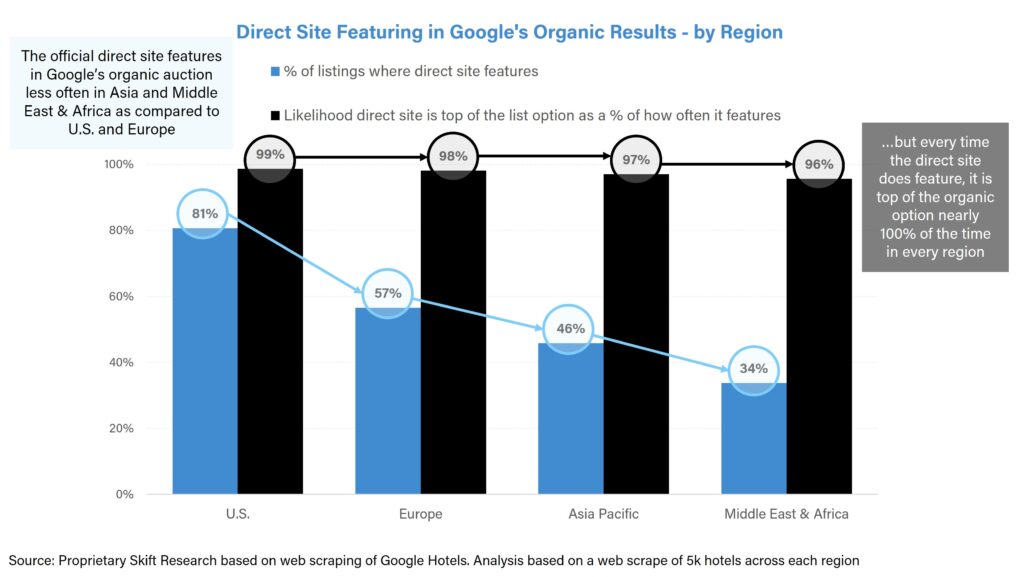

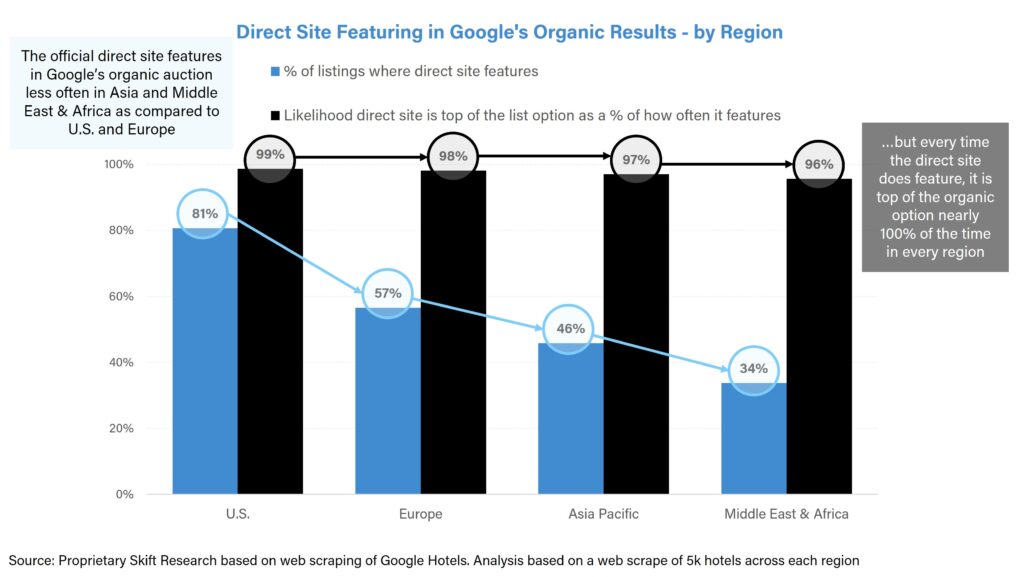

Google’s organic auctions prioritize direct sites in any region

Sites in Asia, the Middle East, and Africa appear directly in Google’s organic auctions less frequently than in the United States and Europe. This is generally because the underlying hotel supply is more fragmented and less branded in the East compared to the West, and independent hotels are more dependent on his OTAs for distribution.

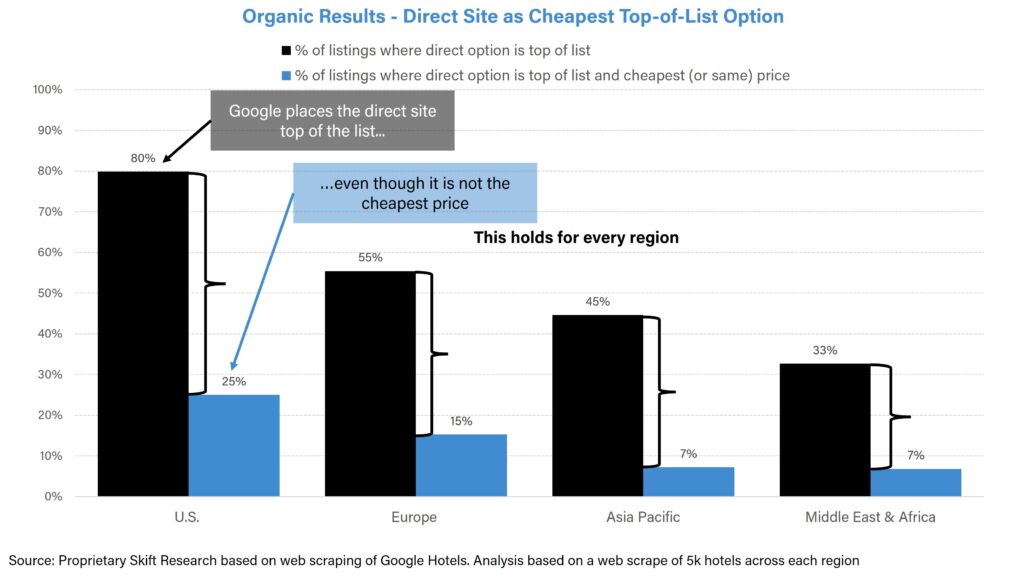

However, if your site works directly, Google will prioritize it to the top of the list almost 100% of the time.

Despite being far from the cheapest, we can see that Google is actively prioritizing direct sites over OTAs. This is true in any region. This shows the role Google is playing in supporting the shift to direct booking.

You can read more about the rise of direct bookings in Skift Research’s latest report, “The Past, Present, and Future of Online Travel.”

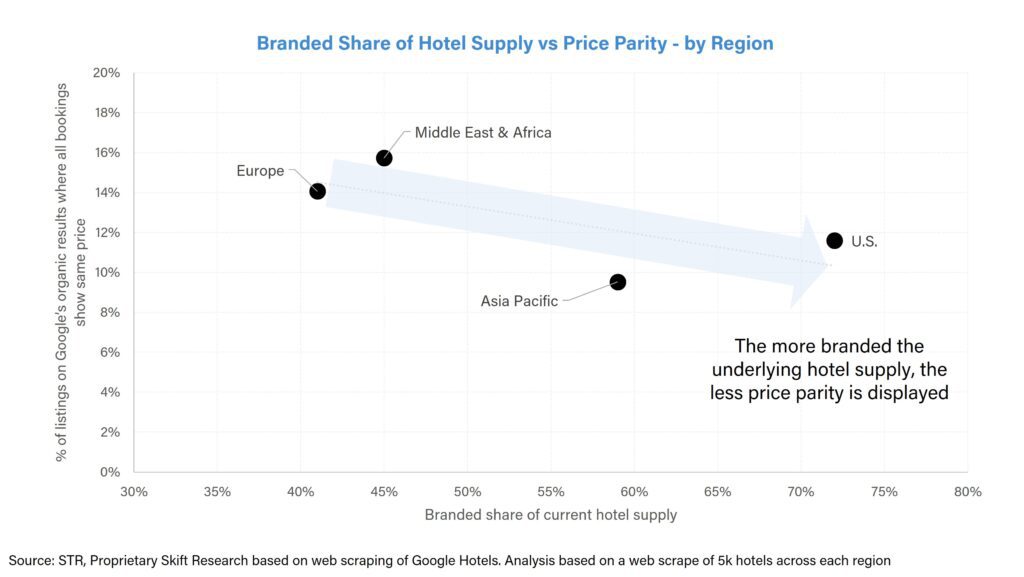

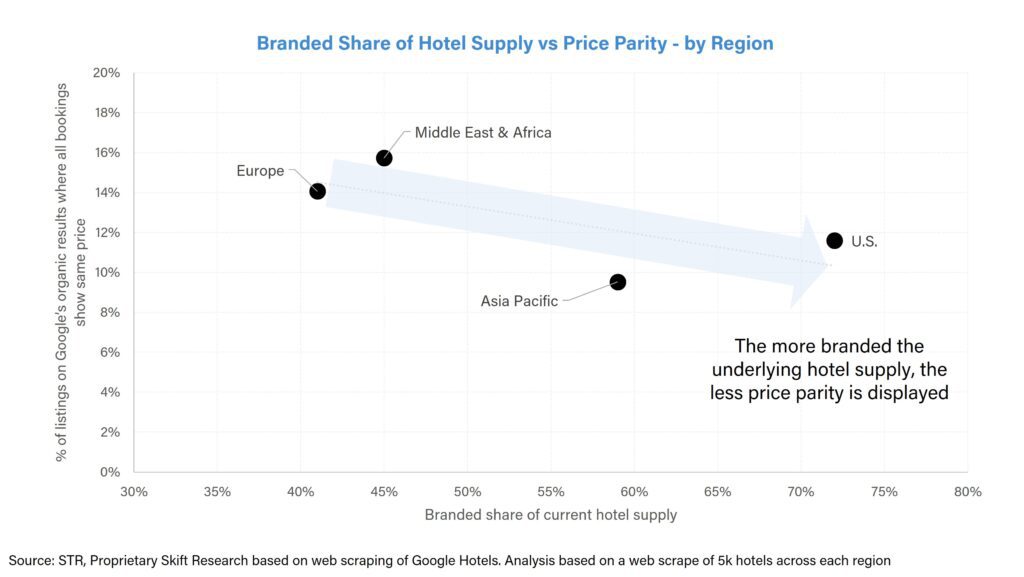

The more branded the underlying hotel supply, the lower the displayed price parity

According to Google’s organic search results, hotels in Europe, the Middle East, and Africa have higher price parity (i.e., the same across different distribution channels for each hotel listing) compared to Asia Pacific and the United States. prices are shown).

Compared to small independent hotels that account for a large share of hotel supply in Europe, the Middle East, and Africa, large brand chains in the United States have the power of scale to negotiate contracts with OTAs and offer exclusive rates through OTAs. can. Loyalty program.

For a more in-depth analysis of Google Hotel web scraping, read the full report. Above, we have highlighted only five of the more than 30 charts included throughout the report, among the key insights.

What you can learn from this report

Proprietary and proprietary analysis based on web scraping of over 20,000 hotels on Google in the US, Europe, Asia Pacific, Middle East and Africa Google’s sponsored (paid) and organic (free) results for each region Compare which OTAs are bidding Analysis of the underlying hotel industry in each region – supply mix of branded and independent hotels, market share of OTAs and direct sites Marketing spend from Bookings and Expedia for sponsored results Efficiency analysis Price parity across regional distribution channels

Do you have suggestions for further analysis of this rich dataset? Contact author Pranavi Agarwal on LinkedIn or email. [email protected].

This is the latest in a series of research reports, analyst sessions and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are aimed at busy travel industry decision makers. Tap into the opinions and insights of our experienced network of staff and contributors. Each report requires over 200 hours of desk research, data collection, and analysis.

Subscribe to Skift Research Report now

By subscribing, you’ll gain access to an entire vault of reports, analyst sessions, and datasheets conducted on a variety of subjects, from technology to marketing strategy to details on leading travel brands. The report is available online in a responsive design format. You can also purchase each report a la carte at a higher price.