Asia’s hard-hit tourism sector is recovering, but a full recovery will not occur without more tourists from China, the world’s largest outbound travel market before the coronavirus outbreak. .

Nearly a year after the Chinese government lifted strict travel restrictions, many countries in the region have The number of people entering the country has not recovered to pre-pandemic levels.

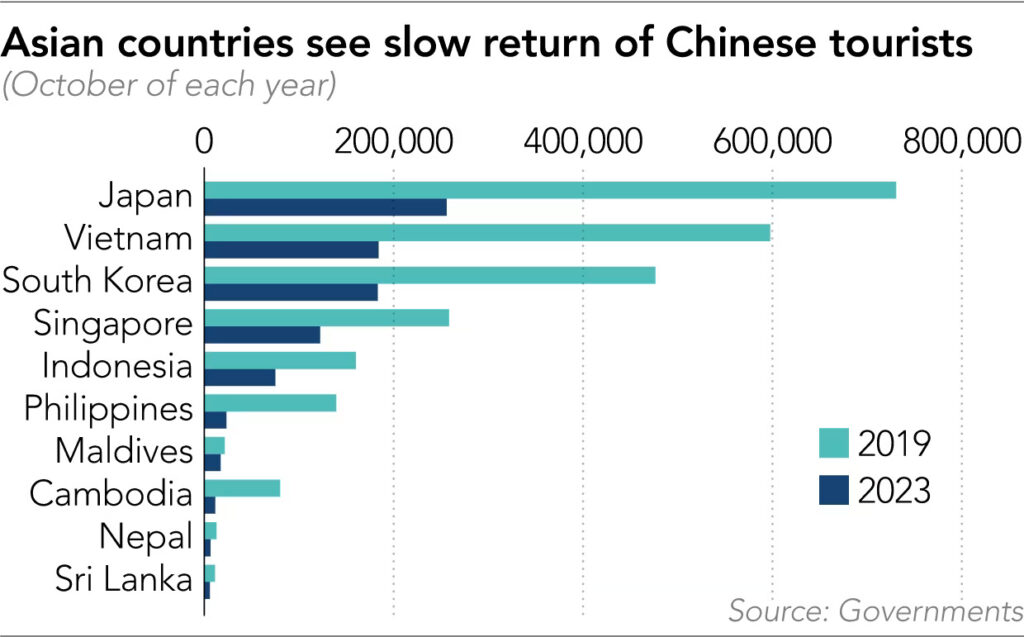

According to statistics from 10 countries for which a breakdown of tourists by country of origin is available, there were 1.6 million fewer Chinese tourists in October 2023 alone than in the same month in 2019, a decline of 64%.

And that didn’t even include Thailand, one of their favorite travel destinations. According to Thailand’s official data, about 11 million Chinese tourists visited the country in 2019, but only 2.8 million arrived in the first 10 months of this year.

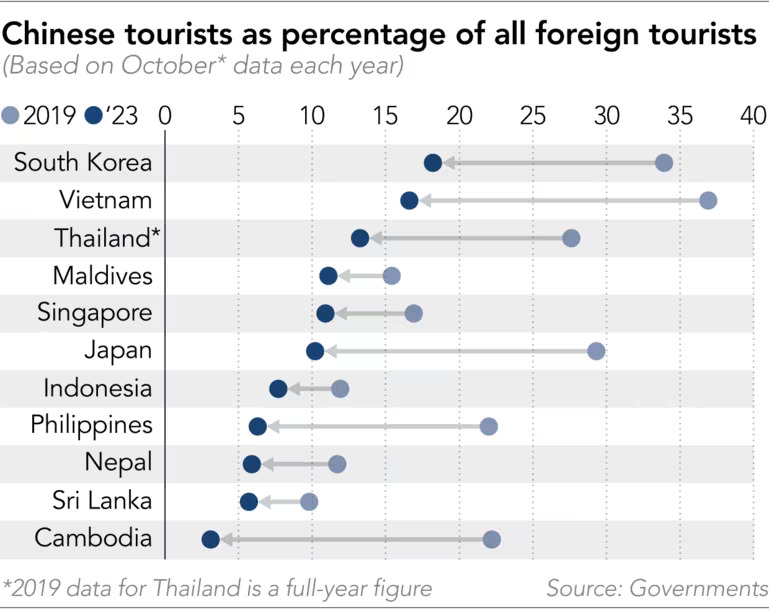

As in the case of Thailand, China was once the largest international tourism market for many Asian countries, and the economic slowdown is hurting the post-COVID-19 recovery of their tourism sectors.

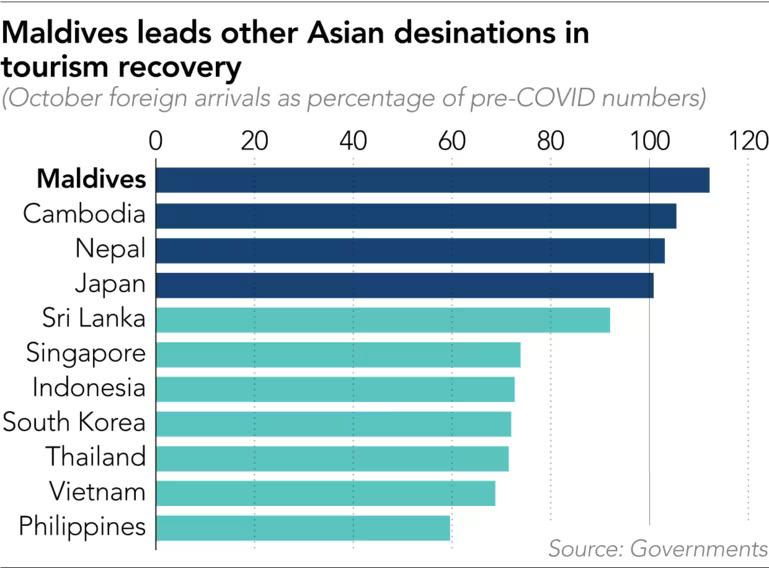

Of these, Vietnam welcomed 1.1 million foreign tourists in October 2023, a decrease of 500,000 from the same month in 2019, while the number of Chinese visitors decreased by 410,000. Similarly, in South Korea, the number of foreign tourists in October 2023 decreased by 390,000 compared to four years ago, of which the number of Chinese tourists decreased by 290,000. Both countries are lagging behind other Asian economies in the sector’s recovery.

Even some countries where overall tourist numbers have exceeded pre-pandemic levels are struggling to attract Chinese tourists back. This includes Japan, with 470,000 fewer visitors from China in October compared to the same period in 2019.

Despite this, Chinese people prefer destinations closer to home when traveling abroad. More than 60% of Chinese outbound travelers will choose to visit the Asia-Pacific region in the first half of 2023, with Thailand, Japan and Singapore among their favorite countries, according to a report by China Tourism Academy, a government agency. It’s at the top of the list. Related institutions.

Ying Zhang, a research analyst at the Economist Intelligence Unit (EIU), cited “weak labor market and uncertainty about future income” as the biggest reasons why Chinese tourists are reluctant to travel abroad. “Strict coronavirus restrictions and real estate issues have severely damaged household incomes and assets,” he told Nikkei Asia in an email, referring to the sharp downturn in the real estate market. “The recovery in China’s outbound tourism will be slow and will not fully recover to pre-pandemic levels until early 2025.”

China is on track to report its slowest annual growth rate in decades, and job insecurity is adding to the worries. Youth unemployment hit an all-time high of 21.3% in June, before the Chinese government decided to stop publishing data altogether.

Jie Sun, CEO of Trip.com Group, a major Chinese travel company, spoke at an earnings conference in November about the lengthy visa application process and that as of the third quarter, “it had only recovered by 50%.” ” cited the ability to operate flights as two “major hurdles.” Towards recovery of outbound business.

Passenger flight capacity between China and most destinations in Asia remains well below pre-COVID-19 levels, according to data from aviation analytics firm Cirium. Data shows that air capacity in the fourth quarter from China to Indonesia, Japan, the Philippines, Thailand and Vietnam remained below half the level in the same period in 2019, while airline capacity to Cambodia remained Capacity remains at 22% of the world. Early period.

As of October, Chinese residents accounted for 3% of total outbound tourists in Cambodia, down from 22% in the same month of 2019.

According to EIU’s Zhang, Chinese households are also choosing to travel domestically for economic reasons. According to official figures, there were 3.7 billion domestic trips in the first three quarters of this year, down just 20% compared to the same period in 2019, but total spending was RMB 3.69 trillion (US$520 billion). , 85% of the level four years ago. .

Ivy Li, 26, who frequently travels to Yunnan province, said, “In recent years, I have realized that many of the scenery we see abroad can be found similar or even better within China.” ” he said.

“My biggest concern is safety while traveling abroad, especially with the scams taking place in Southeast Asia,” Lee added.

Many Chinese expressed similar concerns on social media, saying they would avoid traveling to countries like Cambodia, which is known as a haven for online fraudsters who traffick people into forced labor.

In a bid to bring back Chinese tourists, Thailand temporarily waived visa requirements for Chinese tourists in late September, but a mass shooting in central Bangkok shortly thereafter may have affected tourist numbers. There is sex. Malaysia and Singapore have also offered visa-free entry to Chinese nationals for stays of up to 30 days.

Despite the slow recovery so far, China’s overseas travel business is picking up ahead of the holiday season. As of December 5, Trip.com’s international travel bookings for the New Year and Lunar New Year periods had increased by 5.74 times and 20 times, respectively, compared to 12 months ago. Tokyo, Seoul, Bangkok, Osaka and Singapore were the most popular destinations in both periods, according to the company’s data.

This article was first published in Nikkei Asia. Republished here as part of 36Kr’s ongoing partnership with Nikkei Shimbun.