In the second half of 2023, a series of publications came out in the media on how a number of nations in Southeast Asia—above all Thailand and Myanmar, but also Sri Lanka—took measures to lift any entry restrictions imposed on Russian citizens. In July 2023, Myanmar allowed 30-day visa-free entries for those who plan to visit the country for tourist or business purposes. In October, Thailand extended the period of visa-free stay for Russian citizens from 30 to 90 days. In November Sri Lanka launched a pilot project to formalize free electronic tourist visas for Russian, Chinese, Indian, Malaysian, Japanese, Thai and Indonesian citizens. While all this had to do solely with tourism and the development of tourist relations, one should take a closer look at the economic changes taking place in the region, which can be seen as drivers of those processes.

The first two decades of the 21st century have undoubtedly brought Russia and the countries of the region closer together in terms of logistics, information and communication systems. While it proved difficult to launch any large-scale bilateral economic projects, the massive flows of Russian tourists visiting Thailand, Indonesia, Vietnam, Cambodia, the Philippines, Malaysia and other countries of the region year after year make up for the lack of significant progress in other areas of cooperation. The pandemic has severely damaged the tourism industry around the world, and countries of Southeast Asia (SEA) are no exception. The recovery of tourist flows from Russia, which the key countries in the region were counting on to revitalize their economies, faced new challenges triggered by the imposition of Western sanctions on Russia after February 2022.

The most serious factors of the connectivity gap were logistics and finance. Although prior to February 2022, experts had uttered their regret that not all countries in the region had direct air links, generally, logistical connectivity remained at a relatively high and comfortable level, courtesy of direct flights to Bangkok, Hanoi and Ho Chi Minh City, operated by both Russia’s Aeroflot and local airlines, as well as the availability of convenient connections in Dubai, Seoul, Beijing and a number of other cities. Low-cost carriers were active within the region, and thanks to them Southeast Asia’s air connectivity was significantly ahead of other modes of transportation in terms of both cost and speed. The pandemic entered significant adjustments to air travel around the world, and the imposition of Western sanctions on the Russian aviation industry created a structural problem for maintaining transportation connectivity between Russia and Southeast Asia.

Despite the difficulties noted above, the need to boost economic development led to governmental measures in several countries seeking to lift many restrictions on Russian tourists. While the overall regional vistas after the pandemic looked quite bright, with regional economic growth of over 4% in 2023, the situation in individual countries of Southeast Asia varied significantly.

Generally, according to the Association of Tour Operators of Russia, in the first half of 2023, Thailand was visited by over 791,000 Russian tourists, Indonesia—by about 80,000, Malaysia—55,000, Vietnam—62,000. The number of visits to Myanmar by Russian tourists last year reached 3,000, demonstrating a two-fold increase compared to 2022. An additional interesting dividend from tourism for the countries of the region was the fact that in 2023 Thailand (along with the UAE and the Indonesian island of Bali) claimed the position of one of the most popular destinations for Russians to buy real estate, edging out Turkey that was the leader in 2022. A factor whose potential is yet to be traced in the coming years is that Russians are gradually getting keener on studying at leading universities of the region, above all in Singapore, but also in Malaysia.

This analysis brings concludes that Russia and the region’s countries are actively looking for new forms of humanitarian connectivity, even though optimal solutions are not yet possible for all of the above-mentioned limitations. The results of this search are most clearly manifested, first of all, in the sphere of tourism as an obvious priority cooperation area, since it can bring fairly quick economic dividends to all partners. Additionally, these new forms will potentially contribute to the development of other areas, ranging from business communication to educational and cultural projects. Despite the continuing sanctions restrictions that have a direct impact on logistics and finance, the pragmatism of Asian countries is also evident due to the need for economic recovery after the pandemic and the desire to maintain their own competitive strength, regardless of geopolitical twists and turns.

In the second half of 2023, a series of publications came out in the media on how a number of nations in Southeast Asia—above all Thailand and Myanmar, but also Sri Lanka—took measures to lift any entry restrictions imposed on Russian citizens. In July 2023, Myanmar allowed 30-day visa-free entries for those who plan to visit the country for tourist or business purposes. In October, Thailand extended the period of visa-free stay for Russian citizens from 30 to 90 days. In November Sri Lanka launched a pilot project to formalize free electronic tourist visas for Russian, Chinese, Indian, Malaysian, Japanese, Thai and Indonesian citizens. While all this had to do solely with tourism and the development of tourist relations, one should take a closer look at the economic changes taking place in the region, which can be seen as drivers of those processes.

Tourism: The Basis for Connectivity and Disruption

The first two decades of the 21st century have undoubtedly brought Russia and the countries of the region closer together in terms of logistics, information and communication systems. While it proved difficult to launch any large-scale bilateral economic projects, the massive flows of Russian tourists visiting Thailand, Indonesia, Vietnam, Cambodia, the Philippines, Malaysia and other countries of the region year after year make up for the lack of significant progress in other areas of cooperation. For example, according to the Russian Federal Tourism Agency, while 37,000 Russian citizens visited Thailand in 2000, in 2014 their number had surged to 1.3 million people. In 2018-2019, the years preceding the pandemic, the number of Russian tourists who visited the Kingdom reached 1.5 million people. A stable upward trend was characteristic of travel from Russia to other countries in the region as well, and all countries of Southeast Asia were visited by more than 2.5 million Russians in 2019 (see Table 1).

Table 1. Number of Russian tourists traveling in ASEAN countries, 2020–2022 (people)

Country

2019

2020

2021

2022

Brunei Darussalam

No data

175

No data

No data

Cambodia

55,653

21,944

357

14,339

Indonesia

158,943

67,491

8,392

74,143

Laos

12,054

3,144

No data

4,410

Malaysia

79,984

28,694

399

33,003

Myanmar

5,259

2,094

594

1,405

Philippines

36,111

12,643

1,027

8,040

Singapore

80,255

28,991

388

9,799

Thailand

1,483,334

587,167

30,759

435,008

Vietnam

646,524

244,966

No data

39,921

ASEAN

2,558,117

997,309

41,916

620,068

Source: https://data.aseanstats.org/visitors

The pandemic has severely damaged the tourism industry around the world, and countries of Southeast Asia (SEA) are no exception. Prior to the COVID-19 pandemic, the Association of Southeast Asian Nations (ASEAN) was actively developing tourism as one of the drivers of regional economic growth. Since 1992, ASEAN has taken deliberate steps to promote the region as a single tourism destination. As of 2019, the tourism sector contributed about 11.7% of region-wide GDP and was a source of employment for over 41 million people (13.2% of SEA-wide jobs). Unsurprisingly, the Association had begun working on measures to support the tourism industry and forms of regional cooperation in this area even before the pandemic was over. However, the recovery of tourist flows from Russia, which the key countries in the region were counting on to revitalize their economies, faced new challenges triggered by the imposition of Western sanctions on Russia after February 2022.

The most serious factors of the connectivity gap were logistics and finance. Although prior to February 2022, experts had uttered their regret that not all countries in the region had direct air links, generally, logistical connectivity remained at a relatively high and comfortable level, courtesy of direct flights to Bangkok, Hanoi and Ho Chi Minh City, operated by both Russia’s Aeroflot and local airlines, as well as the availability of convenient connections in Dubai, Seoul, Beijing and a number of other cities. Low-cost carriers were active within the region, and thanks to them Southeast Asia’s air connectivity was significantly ahead of other modes of transportation in terms of both cost and speed. The pandemic entered significant adjustments to air travel around the world, and the imposition of Western sanctions on the Russian aviation industry created a structural problem for maintaining transportation connectivity between Russia and Southeast Asia.

For two years, the countries of Southeast Asia and Russia have been jointly searching for options to overcome the logistical gap, which has not yet been fully offset. A palliative solution was the restoration of direct Aeroflot flights to Bangkok, the capital of Thailand, which, in fact, has become the most important transportation hub for Russians in the region, as well as the launch of direct flights from the countries of the region by medium-haul aircraft to Siberian cities in Russia. Positive changes have also been seen in the development of tourist ties between Russia and Vietnam, where direct Aeroflot flights between Moscow and Ho Chi Minh City were launched starting on January 31, 2024. However, there have been no major breakthroughs in financial settlements for the tourism industry. Despite the fact that a number of countries in the region, including Indonesia, Thailand and Vietnam, planned to use cards of the Russian payment system Mir, these plans never materialized due to fears of secondary sanctions against the banking systems of these countries.

The Market Still Matters

Despite the difficulties noted above, the need to boost economic development led to governmental measures in several countries seeking to lift many restrictions on Russian tourists. While the overall regional vistas after the pandemic looked quite bright, with regional economic growth of over 4% in 2023, the situation in individual countries of Southeast Asia varied significantly.

Thus, in Thailand, throughout the pandemic, the tourism industry’s contribution to GDP fell from 20.3% in 2019 to 5.8% in 2021, in Indonesia from 5.6% to 2.4% during the same period, in the Philippines from 22.5% to 10.4%, and in Myanmar from 6.5% to 2.1%. Additionally, the economic situation in Thailand significantly deteriorated compared to its regional neighbors due to a set of structural-economic factors and political instability, whereas the military government that had come to power in Myanmar in 2021 faced serious international restrictions and sanctions from Western nations in addition to the challenges of the pandemic.

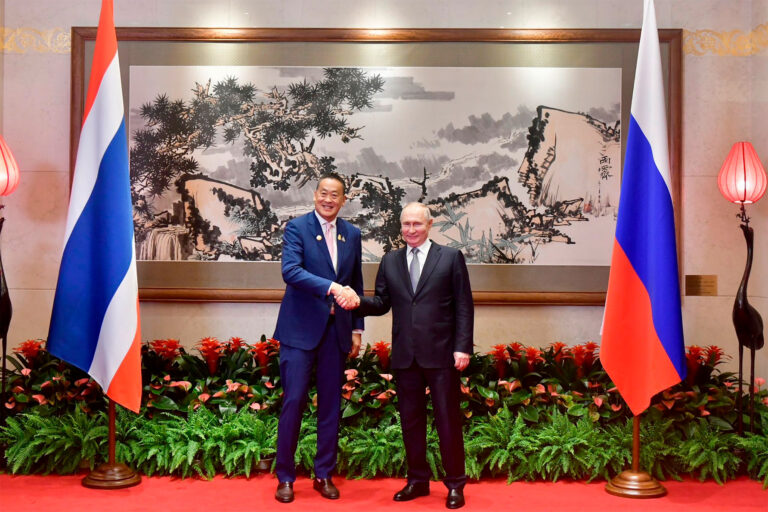

Taking into account the general challenges that the tourism industry had to deal with and country specifics, the governments of those nations, apparently, chose a conscious course towards further appealing to Russian tourists. The period of visa-free stay for Russians in Thailand was extended on the eve of the meeting of Thai Prime Minister and Russian President Vladimir Putin at the Belt and Road Initiative forum in Beijing in October 2023 and became a kind of friendly gesture towards Russia. Among additional measures to stoke the interest of country residents in each other, it is worth noting that 2024 was declared a cross year of cultural exchanges and tourism between Russia and Thailand.

In Myanmar, the tourism and hospitality industry has been included by the government in the list of strategic areas for economic development and foreign investment attraction. With sanctions imposed by Western countries on both Russia and Myanmar, the Myanmar government has taken a number of active steps to increase its tourist appeal to visitors from Russia. These include launching direct flights on the Yangon-Mandalay-Novosibirsk route by Myanmar Airways International in September 2023 (before that, direct flights between Russia and Myanmar were carried out more than 30 years ago, and many capitals of Southeast Asia could be reached only with a connection in Yangon, then Rangoon), attracting tourists from Russian regions by developing package tours to visit several ancient Myanmar cities. Additionally, while visiting Moscow in late January 2024, Myanmar’s Minister of Investment and Foreign Economic Relations Kan Zaw announced the launch of the Mir payment system in Myanmar starting on February 20, 2024.

Generally, according to the Association of Tour Operators of Russia, in the first half of 2023, Thailand was visited by over 791,000 Russian tourists, Indonesia—by about 80,000, Malaysia—55,000, Vietnam—62,000. The number of visits to Myanmar by Russian tourists last year reached 3,000, demonstrating a two-fold increase compared to 2022. An additional interesting dividend from tourism for the countries of the region was the fact that in 2023 Thailand (along with the UAE and the Indonesian island of Bali) claimed the position of one of the most popular destinations for Russians to buy real estate, edging out Turkey that was the leader in 2022. A factor whose potential is yet to be traced in the coming years is that Russians are gradually getting keener on studying at leading universities of the region, above all in Singapore, but also in Malaysia.

***

This analysis brings concludes that Russia and the region’s countries are actively looking for new forms of humanitarian connectivity, even though optimal solutions are not yet possible for all of the above-mentioned limitations. The results of this search are most clearly manifested, first of all, in the sphere of tourism as an obvious priority cooperation area, since it can bring fairly quick economic dividends to all partners. Additionally, these new forms will potentially contribute to the development of other areas, ranging from business communication to educational and cultural projects. Despite the continuing sanctions restrictions that have a direct impact on logistics and finance, the pragmatism of Asian countries is also evident due to the need for economic recovery after the pandemic and the desire to maintain their own competitive strength, regardless of geopolitical twists and turns.